The price of bitcoin has become a hot topic in Canada over the past few months with the bull run in December and then the large correction in January. Everyone seems to have a strong opinion on whether bitcoin will inevitably go to $100,000 or crash to $0.

I’ve been receiving emails asking me how to bet on the price of bitcoin, so I decided to write this page outlining how you can margin trade bitcoin at Bitmex.com. Margin trading allows you to buy long or short bitcoin futures contracts, which is essentially betting on bitcoin price movement.

Follow the four step guide I’ve outlined below to begin betting on the price of bitcoin. I’ve also added an FAQ at the bottom of the page which you should read if you are not experienced buying or selling futures contracts.

Bet On Bitcoin Price In Canada – Guide

Follow these four steps to margin trade bitcoin, which is simply betting on bitcoin’s price to go up or down.

#1. Open an Account at Bitmex.com

First you will need to open an account at a site that offers bitcoin margin trading and accepts Canadians. Bitmex.com, the Bitcoin Mercantile Exchange, is the top site in the industry offering a peer to peer trading platform for bitcoin contracts.

By signing up through our link you will receive a 10% discount on all fees associated with trading bitcoin contracts for the first 6 months.

#2. Deposit Bitcoin

Now that you’ve opened your account you will need to fund it in order to be able to bet on the price movements of bitcoin.

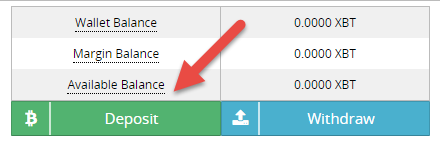

Bitcoin is the only currency accepted at the site. To deposit bitcoin select ‘Account’ in the top navigation bar and then select the green ‘Deposit’ button as shown in the screenshot below:

**If you do not own bitcoin, you will need to purchase some to transfer to Bitmex.

#3. Long or Short Bitcoin

Now that you have bitcoin in your account you are ready to bet on bitcoin price movements.

If you expect bitcoin to increase in price then you would want to buy or long bitcoin, while if you expect bitcoin to decrease in price then you want to sell or short bitcoin.

Here is an example of buying a long contract, which is essentially a bet on bitcoin increasing in price.

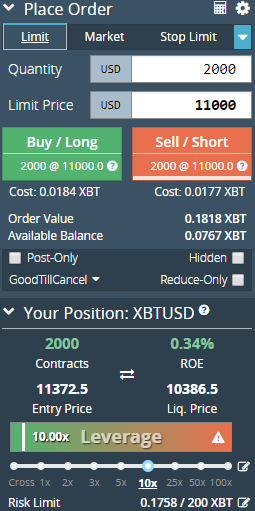

Once on the ‘Trade’ screen you will see the ‘Place Order’ option in the left sidebar. In this section you will need to enter the information about the contract you would like to buy or sell. This includes the following:

- Quantity of contracts – The contracts at Bitmex all have a value of $1 USD.

- Limit Price – The price at which you want to long or short bitcoin.

- Leverage – You can use up to 100X leverage at Bitmex. The higher the leverage you choose the lower your risk for the same amount of contracts, but the higher your liquidation price.

Here’s an example of purchasing a long contract, which is betting on bitcoin going up:

In this example I’m looking to purchase 2000 contracts ($2000 USD value) at a bitcoin price of 11000. If you look at the bottom of the picture you will see that I have selected 10x leverage. This means that I’m only actually risking $200 worth of bitcoin on this order ($2000 value at 10x leverage). The leverage allows me to risk more money, but it also increases my risk of being liquidated.

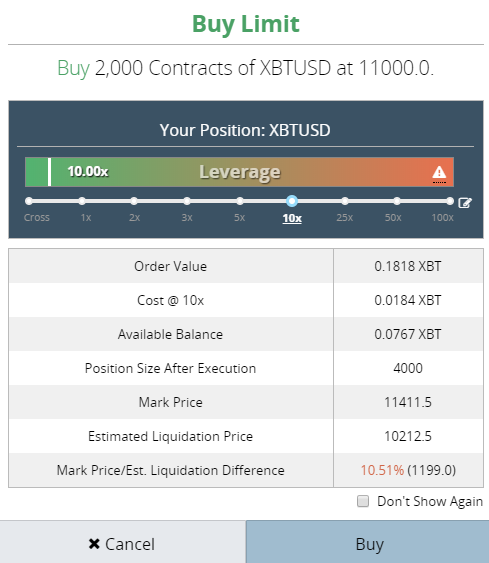

This is what the ‘confirm order’ page will look like after you click the ‘Buy/Long’ or ‘Sell/Short’ buttons in the above example. The most important thing to look at in this example is the ‘Estimated Liquidation Price’ which is the second last row in the box. The estimated liquidation price for this example is 10212.5. That means that if the bitcoin price ever dips below $10,212.50 your position will be liquidated and you will lose the cost of your contract, which in this case was $200 (0.0184 bitcoin).

#4. Close Your Position

Now that you’ve opened a position you will need to close it at some point to realize a profit (hopefully) or a loss. You can either select a limit price where you will sell your contract and close your position, or close the position at the market price at any point in the future.

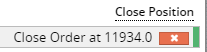

In the above example I have set a close position at 11934. This means that once the price of bitcoin hits $11,934 my contract would be sold and I would realize my profit. Here’s a screenshot of how that would look:

So if I left this position as it is, I would realize profits if bitcoin reaches $11,934 and my contract would be liquidated for a loss at a price of $10,212.

Ready to bet on bitcoin? Click here to visit Bitmex.com.

I just want to do a quick disclaimer….

There’s a reason I considering using Bitmex as betting on bitcoin. It’s much closer to gambling than investing. I suggest using the Testnet to get the hang of things and not using high leverage at first. I’ve added a little FAQ below, but I also suggest reading all of the in depth articles at the Bitmex website to understand exactly how everything works. That said, if you have strong feelings about bitcoin one way or the other, Bitmex is definitely the easiest way to wager on it’s price movements.

More On Bitcoin Margin Trading at Bitmex

Here are a few basic questions I’ve gotten about using Bitmex.com to bet on the price of bitcoin:

What is Bitmex?

Bitmex is the trading platform that allows you to buy and sell bitcoin futures contracts.

What is the liquidation price?

When the mark price (the average price of bitcoin between the GDAX and Bitstamp bitcoin exchanges) falls below your liquidation price for longs or rises above your liquidation price for shorts your contract will be closed at the current price.

The liquidation price is basically a set price where your contract is closed because you have used up all of the maintenance margin for that position.

Are there fees?

Yes, there are fees for trades at Bitmex, but not deposits or withdrawals. Check out the Bitmex website for all the fee details.

**If you have any other questions contact me and I will answer and add to this page.

Tagged With : bet on bitcoin • betting on bitcoin • bitcoin • bitcoin betting • bitcoin margin trading • bitcoin price